How to Earn Money online 2023

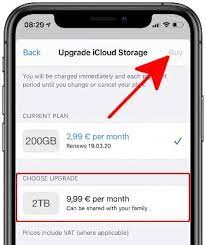

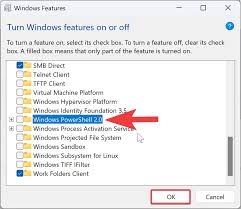

If you’re looking to make money using your mobile phone, I’ve got you covered. Follow my guidance, and you’ll be on your way to earning in no time. Allow me to share an exciting opportunity with you, especially during the blessed month of Ramadan. I want you to make the most of this sacred time,… Read More »